Equip Your Company: Bagley Risk Management Insights

Equip Your Company: Bagley Risk Management Insights

Blog Article

Just How Livestock Danger Defense (LRP) Insurance Can Safeguard Your Animals Financial Investment

In the realm of livestock investments, mitigating threats is paramount to ensuring financial stability and development. Livestock Risk Defense (LRP) insurance coverage stands as a reputable guard against the uncertain nature of the market, providing a strategic strategy to safeguarding your properties. By delving into the complexities of LRP insurance and its multifaceted advantages, livestock manufacturers can strengthen their investments with a layer of safety and security that goes beyond market changes. As we discover the world of LRP insurance policy, its function in protecting animals financial investments comes to be progressively noticeable, guaranteeing a course towards sustainable economic strength in an unpredictable sector.

Comprehending Livestock Danger Security (LRP) Insurance

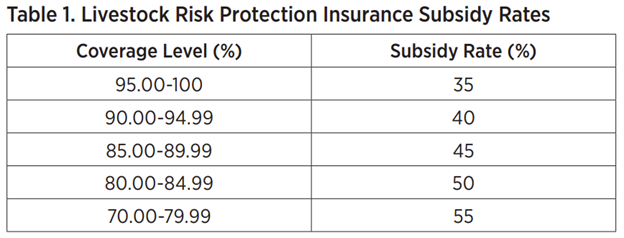

Understanding Animals Danger Defense (LRP) Insurance policy is crucial for livestock manufacturers seeking to reduce monetary threats associated with price variations. LRP is a federally subsidized insurance policy item made to secure producers against a decrease in market value. By giving insurance coverage for market rate declines, LRP assists producers lock in a flooring cost for their animals, guaranteeing a minimal level of earnings despite market variations.

One trick element of LRP is its versatility, enabling producers to personalize insurance coverage degrees and policy sizes to suit their particular requirements. Producers can choose the number of head, weight array, coverage rate, and protection period that straighten with their manufacturing goals and run the risk of resistance. Understanding these adjustable options is critical for manufacturers to successfully manage their cost threat direct exposure.

Moreover, LRP is readily available for various animals kinds, consisting of cattle, swine, and lamb, making it a flexible threat management tool for animals producers throughout various markets. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, producers can make informed decisions to protect their financial investments and make sure financial stability despite market uncertainties

Benefits of LRP Insurance for Animals Producers

Livestock manufacturers leveraging Animals Risk Protection (LRP) Insurance obtain a tactical benefit in securing their investments from price volatility and protecting a secure economic ground among market uncertainties. By setting a floor on the rate of their livestock, manufacturers can mitigate the threat of substantial monetary losses in the occasion of market recessions.

Additionally, LRP Insurance provides producers with tranquility of mind. Overall, the advantages of LRP Insurance coverage for animals manufacturers are significant, providing a valuable device for taking care of danger and making sure monetary safety in an unpredictable market environment.

How LRP Insurance Coverage Mitigates Market Dangers

Minimizing market threats, Animals Danger Defense (LRP) Insurance provides livestock manufacturers with a dependable shield versus cost volatility and financial unpredictabilities. By using protection versus unexpected rate drops, LRP Insurance helps manufacturers protect their financial investments and maintain financial security in the face of market variations. This type of insurance permits livestock manufacturers to lock in a price for their animals at the beginning of the policy duration, ensuring a minimal cost level regardless of market modifications.

Actions to Secure Your Livestock Financial Investment With LRP

In the realm of agricultural danger administration, applying Animals Danger Security (LRP) Insurance involves a tactical procedure to protect financial investments versus market variations and uncertainties. To safeguard your animals investment properly with LRP, the initial step is to evaluate the specific dangers your operation deals with, such as click price volatility or unexpected climate occasions. Next, it is crucial to research study and select a respectable insurance coverage provider that uses LRP plans tailored to your livestock and organization requirements.

Long-Term Financial Safety With LRP Insurance Coverage

Making sure enduring economic stability with the application of Animals Threat Protection (LRP) Insurance policy is a prudent lasting approach for farming manufacturers. By including LRP Insurance into their threat management strategies, farmers can guard their livestock investments versus unpredicted market changes and negative occasions that might threaten their financial well-being gradually.

One trick advantage of LRP Insurance for lasting financial safety is the comfort it supplies. With a trusted insurance plan in location, farmers can minimize the economic dangers related to unpredictable market conditions and unexpected losses due to factors such as condition break outs or natural calamities - Bagley Risk Management. This stability enables producers to concentrate on the everyday operations of their livestock service without constant stress over potential monetary problems

Additionally, LRP Insurance provides an organized method to managing threat over the long-term. By setting particular insurance coverage degrees and choosing ideal endorsement durations, farmers can tailor their insurance plans to line up with their economic goals and run the risk of tolerance, guaranteeing a safe and secure and lasting future for their animals procedures. Finally, buying LRP Insurance coverage is an aggressive technique for farming manufacturers to attain enduring economic safety and shield their source of incomes.

Conclusion

Finally, Livestock Threat Defense (LRP) Insurance coverage is a useful device for animals manufacturers to mitigate market threats and safeguard their investments. By understanding the benefits of LRP insurance and taking steps to implement it, manufacturers can attain long-term financial security for their operations. LRP insurance coverage offers a safety net versus price fluctuations and guarantees a level of stability in an unpredictable market atmosphere. It is a sensible selection for safeguarding livestock financial investments.

Report this page